Profile feature: Payment Tracker

Enabling the Payment Tracker feature allows you to track expenses from line items and other factors that may affect the estimate total. You can also track and adjust payments made throughout the estimate process and prepare important reports regarding payment history in the project.

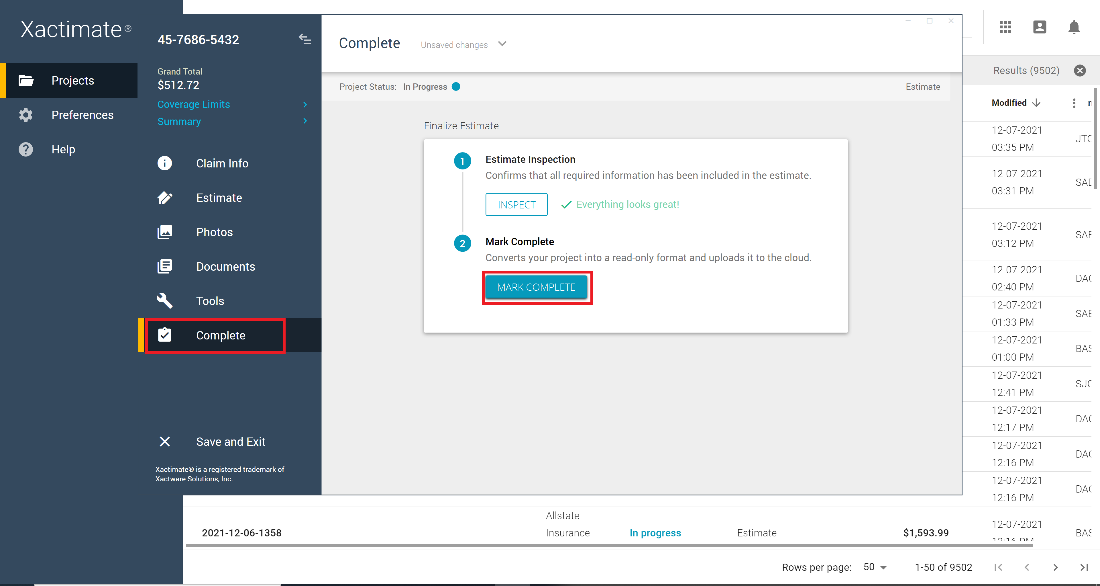

Before using Payment Tracker, the project you're working on must be marked Complete.

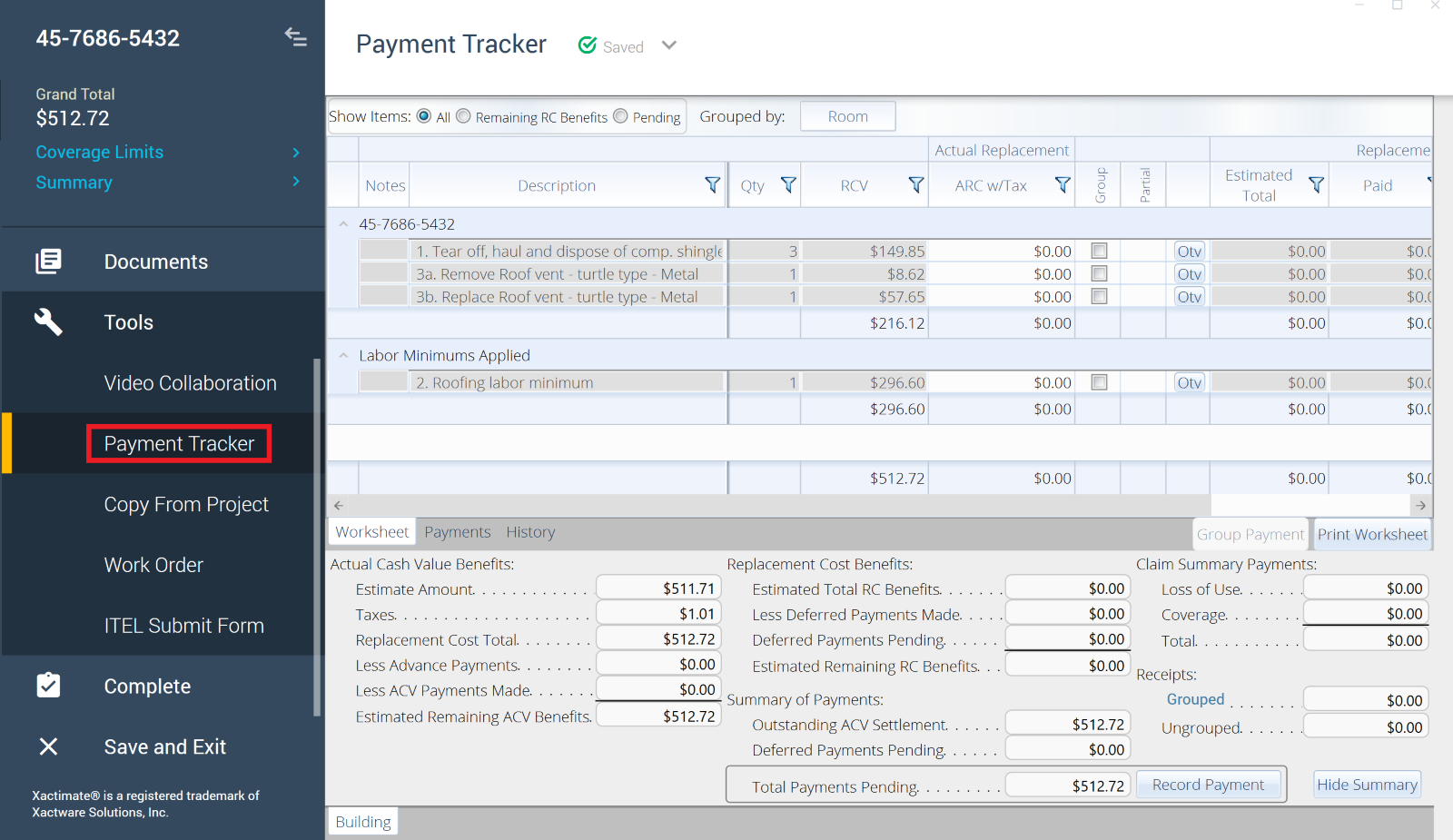

Click Tools to display the Tools menu. Then, select Payment Tracker to open it.

Payment Tracker consists of three parts: the Worksheet tab, the Payments tab, and the History tab.

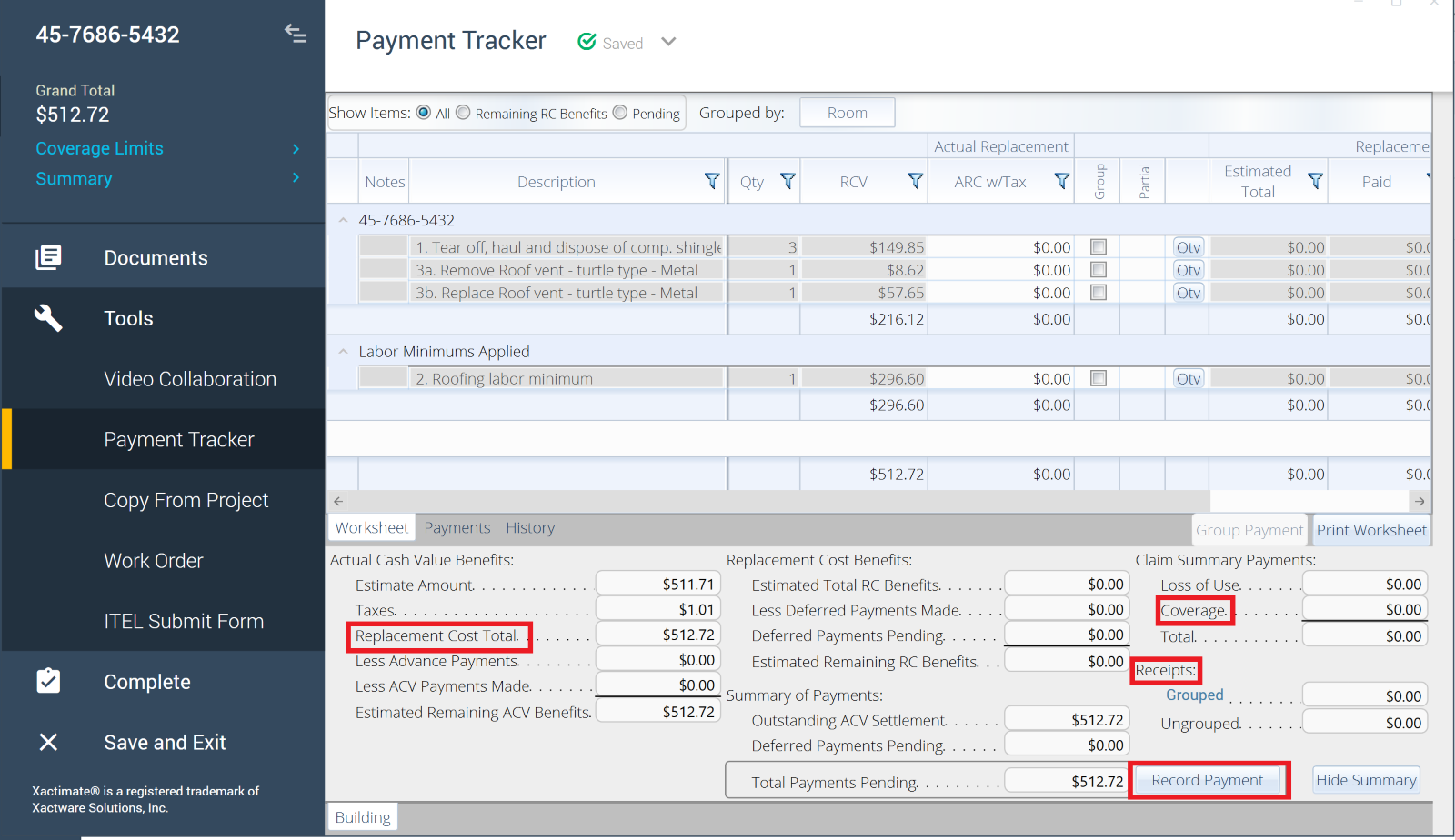

Payment Tracker worksheet. The Worksheet tab displays line items from the estimate, grouped according to category or room. In this worksheet, among other things, you can:

- Expand or collapse categories to show or hide item details.

- Filter items by clicking the funnel icon in the column headers.

- Remove filters by selecting the funnel icon

and then selecting Clear Filter.

and then selecting Clear Filter. - Make and record payments.

- View coverage payments.

- Enter estimate receipts.

- Calculate replacement amounts.

Payment Tracker payments. The Payments tab displays payments made to the insured. From this tab, you can:

- Void payments.

- Re-issue payments.

- Make advanced payments or loss-of-use payments.

- Print a payment summary.

- Print a Payment details report of any listed payment.

- Reset all payments.

Payment Tracker history. The History tab creates history reports that display everything that occurs within the estimate to a certain point in time, and it continually updates as the estimate changes and new data is entered in Payment Tracker. Reports available in the History tab can be helpful for policyholders and may include:

- History of deferred payments: This report is available after deferred payments are made.

- History of supplement payments: This report is available after supplement payments are made.

- Items with estimated amounts remaining: This report is available if replacement cost benefits have not been paid for items with recoverable depreciation.

- Item receipts: This report is available when receipts are entered in the Receipts management window.

To learn more about how to use Payment Tracker, read our tutorials.

This profile feature is enabled by default. If you'd like to disable this feature, follow the instructions in this article.