Depreciation in Xactimate online

Depreciation is the difference between the actual cash value (ACV) of an item and the cost to repair or replace it. Depreciation adjusts the value of physical assets based on item category, age, condition, and usage. You can set depreciation in two different locations in Xactimate online.

Preferences

Settings in Preferences apply to all projects in the specified profile.

- Select Preferences on the left-hand side of the Projects page.

- Select your profile from the Select profile dropdown menu.

- Select Recoverable or Non-recoverable in the DEPRECIATION section.

- Recoverable depreciation: Recoverable depreciation applies to the initial project or settlement of an Actual Cash Value (ACV) policy. Depreciation may be recovered after certain requirements in a replacement cost coverage policy are met.

- Non-recoverable depreciation: Non-recoverable depreciation applies to the initial project or settlement of an ACV policy. However, depreciation cannot be recovered.

- Choose how to measure depreciation by selecting the Age/Condition, Percent (%), or Amount (Amt) button.

Parameters

Settings in Parameters apply to individual projects.

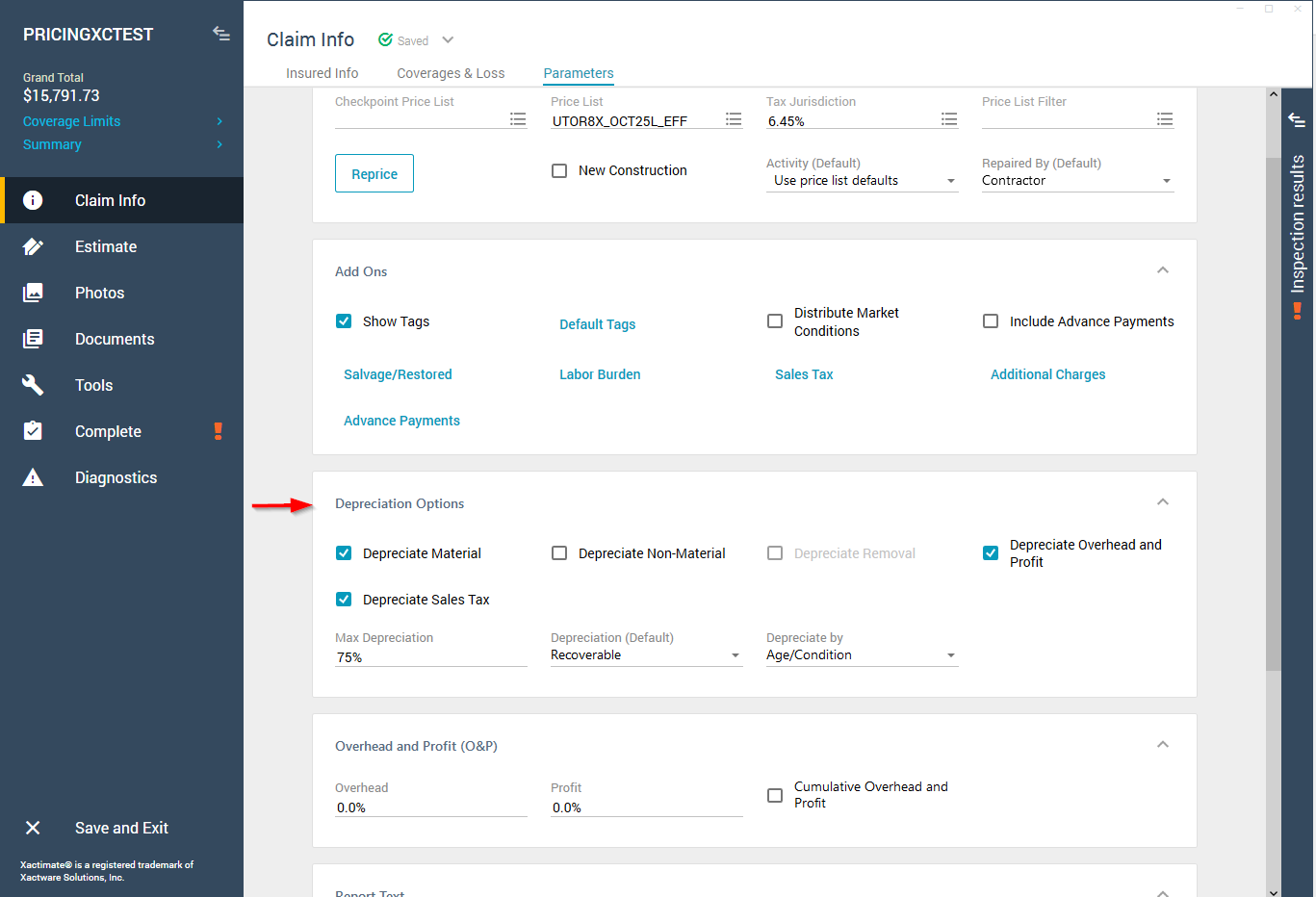

- Within an open project, navigate to Claim Info.

- Select Parameters.

- In Depreciation Options, select the desired type(s) of depreciation.

- Depreciate material: This allows depreciation to be applied to physical items, such as cabinets, carpet, and other such items.

- Depreciate non-material: If this option is selected, depreciation can be applied to non-labor items, not including materials.

- Depreciate removal: When this option is selected, depreciation can be applied to removal components.

- Depreciate overhead and profit: If this option is selected, depreciation can be applied to overhead and profit.

- Depreciate sales tax: If this option is selected, depreciation can be applied to sales tax.

You can also set the max depreciation percentage, default depreciation (including recoverable and nonrecoverable), and what to depreciate by.

Note: Not all insurance carriers and regulatory agencies allow for every type of depreciation.

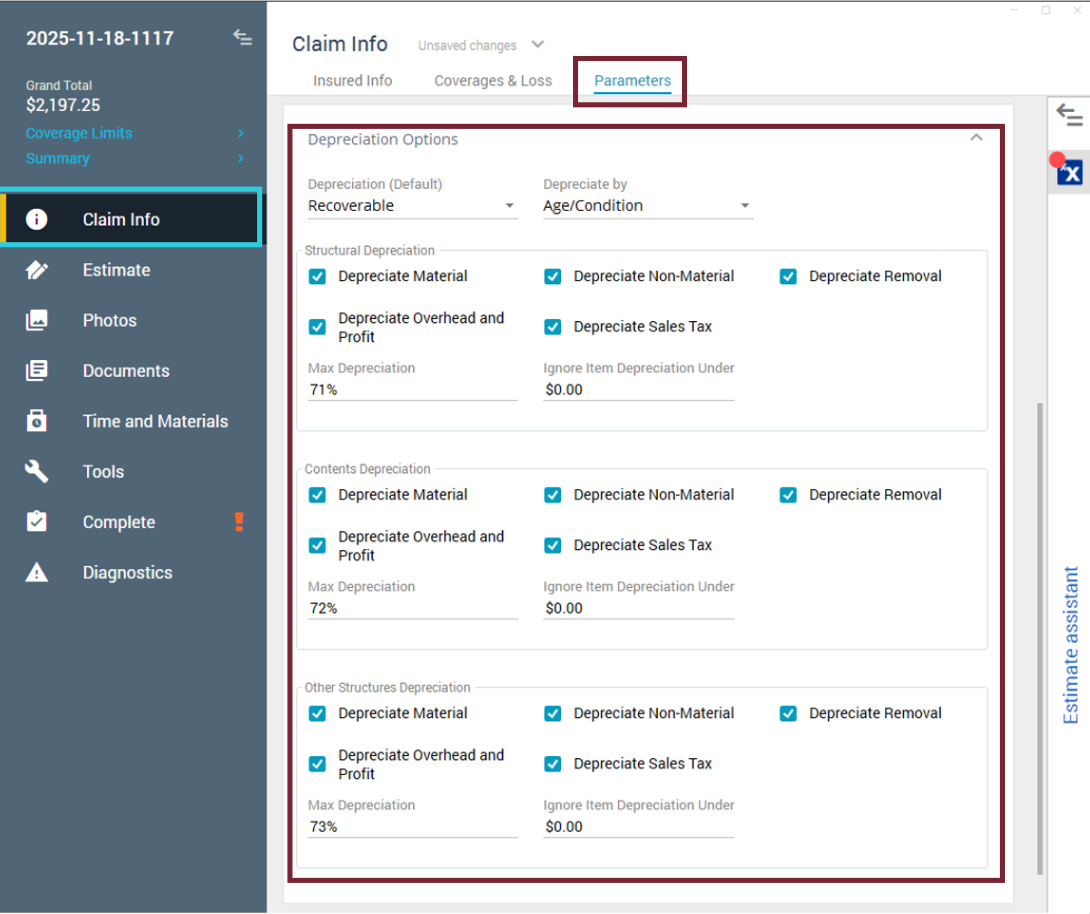

Depreciation Options may appear differently depending on whether Depreciation by Coverage Type is active for your instance in the state in which the project address is listed. To learn how to set depreciation for instances, review our Set depreciation defaults in instances in Xactimate Admin article.

If Depreciation by Coverage Type is active, the coverage options are divided across three areas of depreciation: Structural Depreciation, Contents Depreciation, and Other Structures Depreciation.

If Depreciation by Coverage Type is not active, the above depreciation options appear only once,and depreciation is applied equally across all coverage types.