Enter coverages and loss information in X1

The Coverage & Loss tab allows you to enter information for the policy including the claim and policy numbers, type and cause of loss, coverage dates and types, and more.

To reach the coverage and loss information, navigate within your estimate to Claim Info > Coverages & Loss.

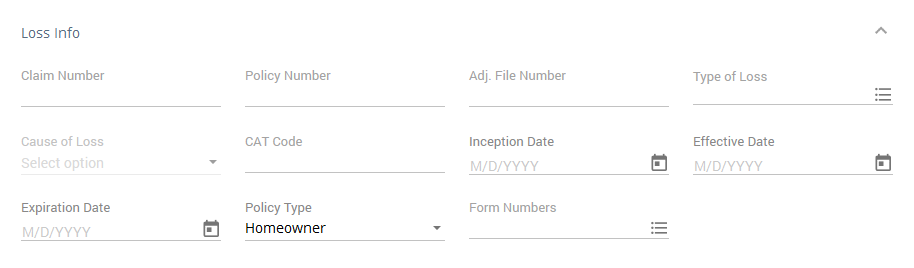

Loss Info

In the Loss Information section, you can enter the details for claim, such as claim and policy numbers, types and cause of loss, dates, etc.

Here are more detailed descriptions for the fields:

Claim Number: The claim number assigned to the claim by the insurer.

Policy Number: The policy number for the insured.

Adj. File Number: The adjudication file number.

Type of Loss: The type of loss (select the menu to see a full list of available options).

Cause of Loss: The cause of the loss (Select the field to view the drop-down menu, which is populated based on the type of loss selected.).

CAT Code: The catastrophe code the insurer assigned to the catastrophe, if applicable.

Inception Date: The date the insurance policy was initiated.

Effective Date: The date the insurance policy coverage began.

Expiration Date: The date the insurance policy ends.

Policy Type: The policy type (homeowner or commercial).

Form Numbers: Other policy and form numbers some companies provide (not common).

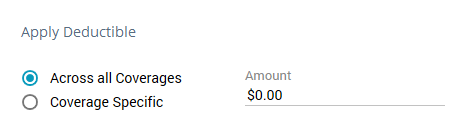

Apply Deductible

In the Apply Deductible section, you can indicate whether a deductible applies across all coverages or if the deductibles are coverage-specific. (A deductible is the amount the insured must pay out-of-pocket before insurance coverage starts.)

Across all Coverages: If the insured has an overall deductible across all their coverages, or has only one main coverage, select Across all Coverages.

Coverage Specific: If the insured has an insurance policy with separate deductibles for specific coverages, select Coverage Specific. Selecting this adds a Deductible column to the Coverages section.

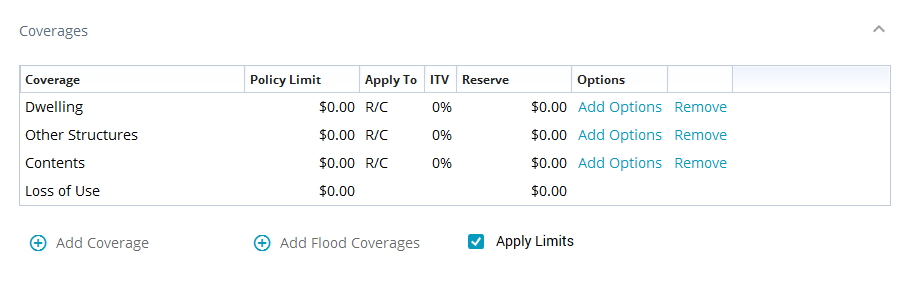

Coverages

In the Coverages section, you can enter information about the insured’s coverage, including type, policy limits, deductibles, etc.

Rows

Xactimate automatically creates rows for the following list.

Dwelling: This generally covers the structure of the house, including walls, floors, doors, etc.

Other Structures: This generally covers structures besides the main house, such as decks, fences, sheds, etc.

Contents: This generally covers items belonging to the insured that would move with them if they moved.

Loss of Use: This generally covers the costs incurred because the insured did not have access to a covered item, such as the cost of food, gas, and a hotel stay.

You can also add other coverages by selecting Add Coverage to add a row. Once the row is added, select the blank field (if it isn’t automatically selected) to open the drop-down menu for additional coverage options; select one of the visible options or select SmartList to open the Coverages window for more options.

Columns

For each column, only enter information for the appropriate rows/coverages. Some columns only appear under certain conditions, and their order may vary. The following columns appear most commonly:

Coverage: The thing(s) to which the coverage/row applies.

Policy Limit: The maximum amount the insurer will pay for the specific coverage

Deductible: The amount the insured must pay out-of-pocket before this coverage starts. Select the drop-down arrow to see the options: Shared with Other Structures, Shared with Contents, Specify Amount, and Percent of Policy Limit. Select the option that best fits your needs or your company standards and then enter the appropriate amount.

Apply to: Whether the coverage applies to the R/C (replacement cost), the ACV (actual cash value of the items), or both.

ITV: The insurance to value is the estimated actual replacement cost of insured property (uncommon).

Reserve: The funding set aside by the insurer for future claims (uncommon).

Factor: Adjustments to the estimated costs of an insurance claim to account for specific coverages and limits outlined in the insurance policy. This can be applied to coverages, line items, activities, categories, etc.; however, factors in this section usually apply to roofing.

Options: Select Add Options or Edit Options to add/edit the sublimit and additional coverage information for this coverage.