Profile feature: Allow Modify Taxes

The Allow Modify Taxes profile feature gives users permission to modify tax rules that are associated with Xactware price lists.

Create custom tax rules in your estimate

- Navigate to Claim Info > Parameters.

- Select Sales tax in the Add ons card. The Estimate sales tax window appears.

- Select Add to add a new tax.

- Enter the new tax name in the Type field.

- Enter the tax rate in the Rate field.

Set the base or category to be taxed

- In the open Estimate sales tax window, select the calculator to the right of the Base field.

- Select the Functions drop-down menu.

- Select the category.

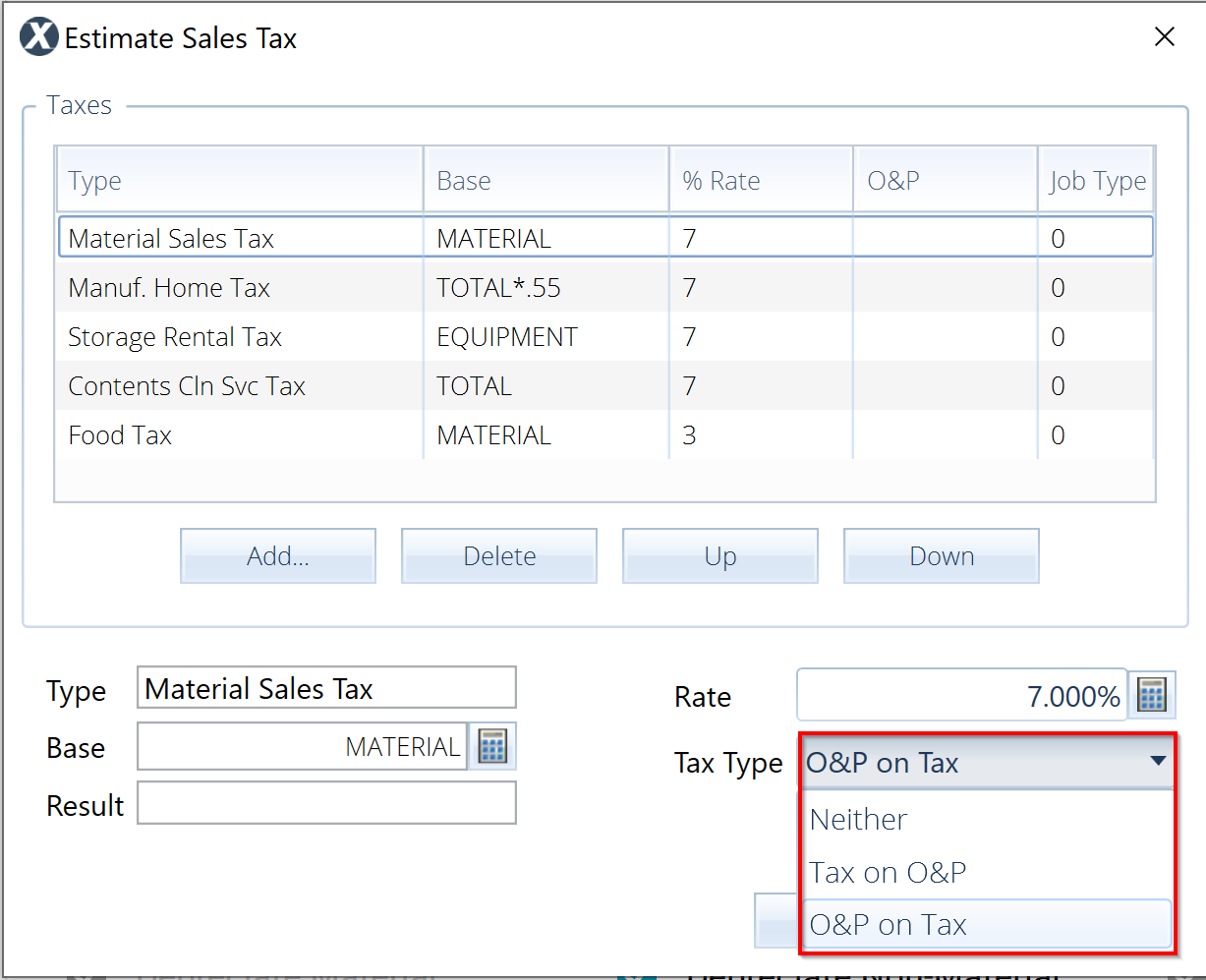

Change how taxes are applied to Overhead and Profit (O&P)

- In the open Estimate sales tax window, select the Tax type drop-down menu.

- Choose the way taxes are applied to O&P. You can choose to apply taxes before or after O&P is calculated or to not have if affect O&P at all.

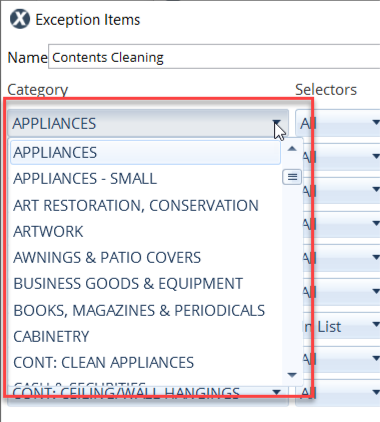

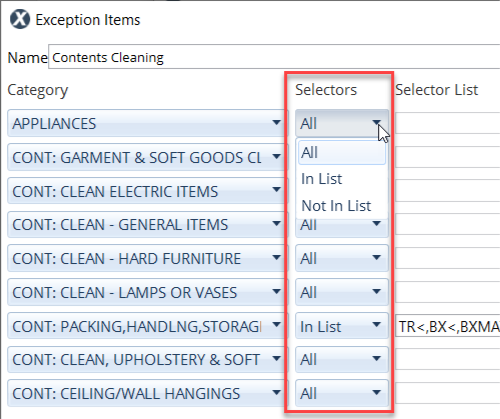

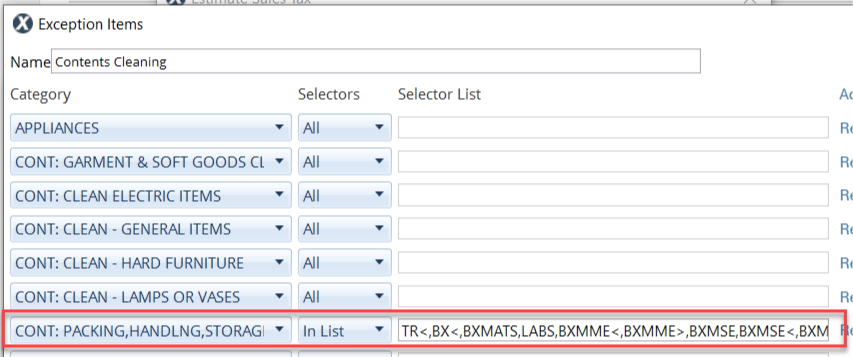

Apply tax exceptions

- In the open Estimate sales tax window, select Exceptions. An Exceptions window appears.

- Select the box for the exception item to select the exception that applies.

- Select the Category drop-down menu and choose a category.

- Select the Selectors drop-down menu and choose whether the exception applies to all items in the list, items in a list, or items not contained in the list.

If you choose In-list items or Not-in-list items, enter them in the Selector list field.

- Select OK. Taxes only apply if the line item is larger than a set amount.

Verify taxes were successfully applied

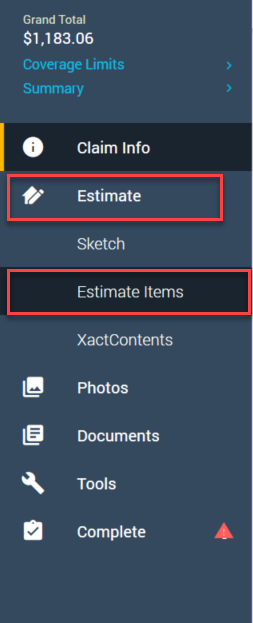

- Select Estimate from the menu to your left.

- Select Estimate items.

- Review the information in the Quick entry section.

This profile feature is on by default. If you'd like to deactivate this feature, follow the instructions in this article.