What happens to my deductible if it's absorbed?

Typically, insurance carriers calculate overages by taking the claim total and subtracting the sum of the policy limit and the deductible. In other words, the deductible is absorbed into the overage. Xactimate does these calculations for you. To make this easier to understand, let’s first define some terms and then go through some examples.

Definitions

Deductible: A deductible is the set amount the insured must pay out of pocket before the insurance will pay anything on a claim.

Policy limit: This is the total amount the insurance company will pay toward a claim.

Overage: An overage is the dollar amount of a claim that exceeds the policy limit.

Absorbed deductible: An absorbed deductible is the insured’s deductible amount applied toward an overage cost.

Examples

This may be easier to understand with some examples.

| Example one | Example two | Example three |

Claim total | $10,000 | $10,000 | $10,000 |

Policy limit/total paid by insurance | $9,000 | $8,500 | $7,000 |

Overage | $1,000 | $1,500 | $3,000 |

Deductible | $100 | $375 | $500 |

Difference paid by insured | $900 | $1,125 | $2,500 |

Total paid by insured | $1,000 | $1,500 | $3,000 |

If there is an overage on a claim, the insured pays all the overage. The deductible is applied and pays for some of the overage, and then the rest is paid out-of-pocket. The insurance only pays the policy limit.

Example one

In a claim with a $10,000 total and a $9,000 policy limit, the insured must pay the entire $1,000 overage. The $100 deductible will apply toward the overage total, and the insured must pay the additional $900 to reach the claim total.

Example two

In a claim with a $10,000 total and an $8,500 policy limit, the insured must pay the entire $1,500 overage. The $375 deductible is applied to the overage, and then the insured must pay an additional $1,125 to reach the claim total.

Example three

In a claim with a $10,000 total and a $7,000 policy limit, the insured must pay the entire $3,000 overage. The $500 deductible is applied to the overage total, and the insured must pay an additional $2,500 to reach the claim total.

Where do I find this information in Xactimate?

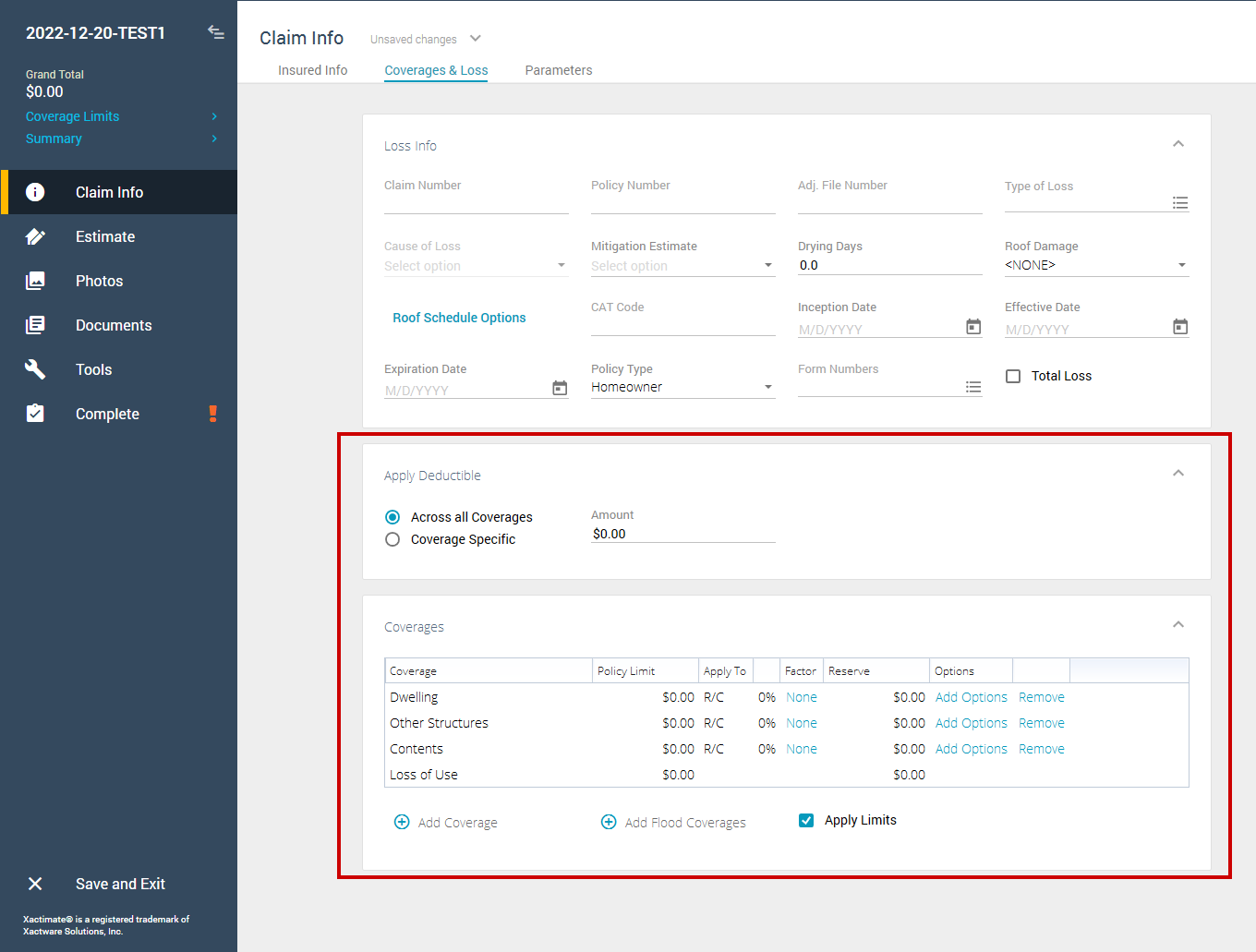

The deductible, policy limit, and coverage information live in Claim Info > Coverages & Loss.

Once you enter the pertinent information, Xactimate completes calculations for you, and the results are available in the summary sections of certain reports.