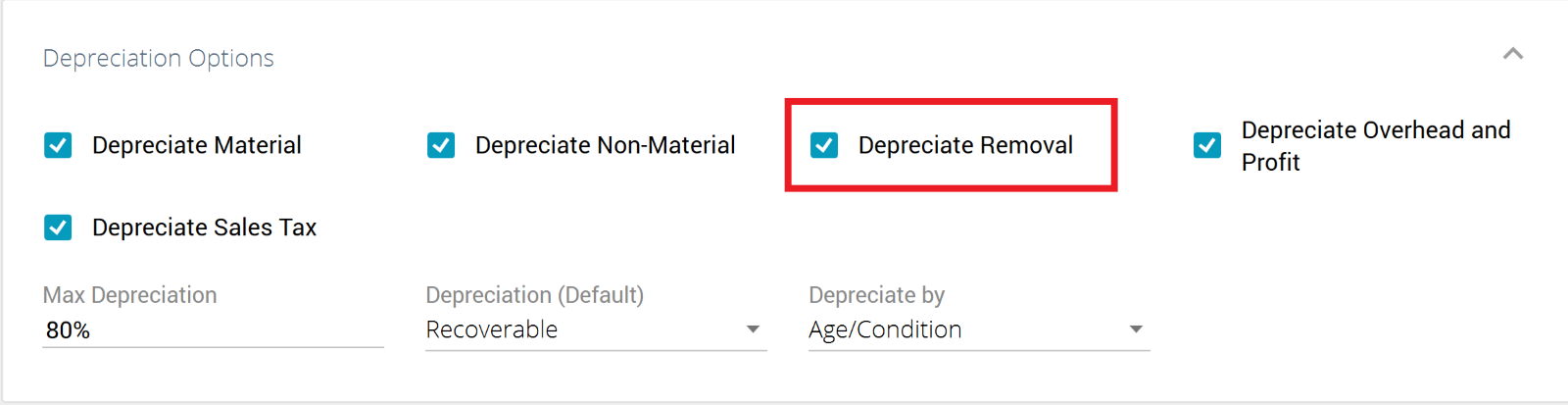

Profile feature: Depreciate removal option is checked

When this profile feature is enabled, the Depreciate Removal checkbox is checked by default, and the estimate automatically depreciates removal. Removal depreciation reduces the original cost of an item by either the amount determined by the depreciation allowed (depreciation deducted on tax returns) or the depreciation allowable (total depreciation that can be deducted based on tax rules), depending on whichever is greater. Policy holders may want to depreciate removal for tax breaks, asset tracking, compliance, and various other reasons.

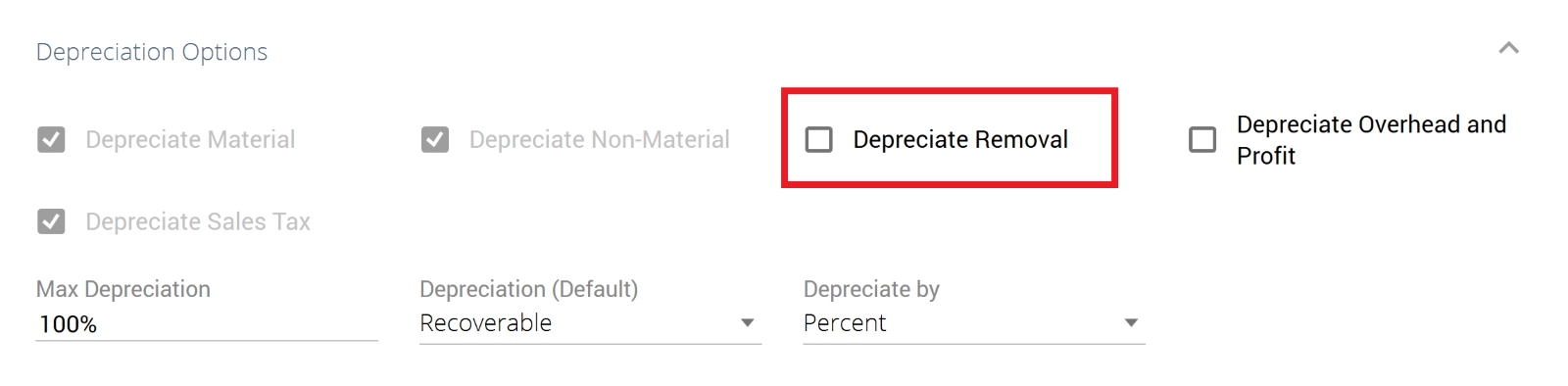

To see the Depreciate Removal checkbox, open an estimate and navigate to Claim Info > Parameters > Depreciation Options.

Profile feature turned on:

Profile feature turned off:

If you'd like to enable this feature, follow the instructions in this article.